Investing in early-stage tokens, particularly meme coins, can offer high returns if you identify the right project at the right time. GasPump, as a launchpad on the TON blockchain, presents a wide variety of token projects, but not all will succeed. Knowing how to spot a promising project is crucial to maximizing your chances of success.

In this article, we’ll explore key strategies and tools for analyzing trends and identifying the most promising projects on GasPump.

1. Examine the Team and Developers Behind the Project

A solid team is the backbone of any successful project. When analyzing projects on GasPump, start by investigating the developers and team members. A project with a transparent, experienced, and reputable team is more likely to succeed than one with anonymous or unknown developers.

- KYC Verification: GasPump requires KYC (Know Your Customer) for many projects, meaning the developers have gone through a verification process. Projects with verified teams are generally safer investments as they reduce the risk of fraud(Gas Pump).

- Developer Experience: Look for developers who have a proven track record in the blockchain space or have worked on successful projects before. Experience in similar projects is a strong indicator of competence(YouTube).

2. Assess the Tokenomics

A project’s tokenomics plays a crucial role in its long-term success. Before investing, consider these factors:

- Supply and Distribution: A token with a fair and well-structured distribution is more likely to maintain value over time. Projects that allocate a reasonable portion to development, marketing, and liquidity often have a more sustainable growth model(DYOR Crypto Screener).

- Vesting Periods: Ensure there are vesting periods for the team and early investors to prevent them from dumping tokens as soon as they become available, which could crash the price(YouTube).

3. Community Engagement

A thriving, active community is a significant indicator of a project’s potential success, especially for meme coins. Meme coins rely heavily on community involvement and hype. Here’s what to look for:

- Social Media Presence: Projects with large and engaged followings on social platforms like Twitter, Telegram, and Reddit are more likely to succeed because they can build strong, loyal communities(DYOR Crypto Screener).

- Engagement Metrics: Don’t just look at the number of followers; analyze how engaged the community is. Projects with active discussions, regular updates from developers, and interactive events (such as AMAs) are more promising(YouTube).

4. Analyze the Use Case and Roadmap

Even meme coins benefit from a clear use case or compelling narrative. Evaluate the project’s whitepaper or website to understand its goals and how it plans to achieve them.

- Feasibility: Does the project have a realistic and achievable roadmap? Overambitious plans with no clear path forward can be red flags(YouTube).

- Innovation: While many meme coins thrive on humor and viral appeal, projects that offer additional features, such as staking, decentralized governance, or integration into other platforms, tend to have more staying power(DYOR Crypto Screener).

5. Security and Audits

As GasPump prioritizes security, many projects undergo smart contract audits. These audits ensure that the project’s code is free from vulnerabilities that could be exploited. Look for:

- Third-Party Audits: Projects that have been audited by reputable third-party firms are much safer to invest in(YouTube).

- Liquidity Locks: Ensure that a project has locked liquidity, preventing the developers from pulling funds out of the liquidity pool, which could lead to a rug pull(YouTube)(Gas Pump).

6. Check Market Sentiment and Trends

Market trends and investor sentiment play a significant role in the success of meme coins. Even the best projects can struggle if the broader market is down or the token fails to generate hype.

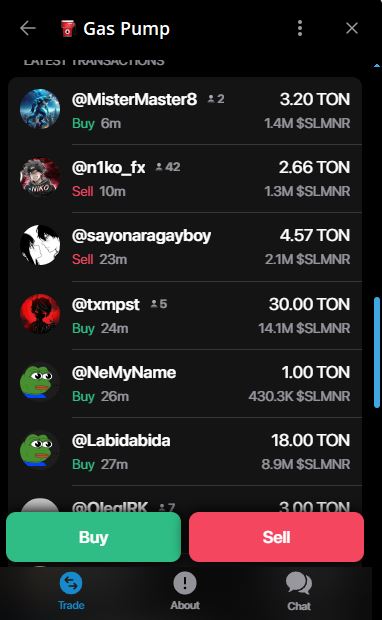

- Trending Tokens on GasPump: Pay attention to the trending projects on GasPump, as these often have the most community interest and early-stage investment potential(Gas Pump).

- Social Media Buzz: Use tools like Google Trends, Twitter analytics, or Telegram engagement metrics to assess how much buzz a project is generating(YouTube).

7. Timing and Market Conditions

Timing is everything in the world of crypto. A token launched during a bull market or period of high market excitement is more likely to gain value quickly than one launched during a market downturn.

- Presale Opportunities: Getting into a project during the presale phase on GasPump can offer significant upside potential, but ensure the project has solid fundamentals before committing(DYOR Crypto Screener).

- Market Sentiment: Keep an eye on broader crypto market trends. If Bitcoin or major altcoins are performing well, meme coins and smaller projects often follow suit(YouTube).

Conclusion

Identifying a promising project on GasPump requires a combination of research, timing, and understanding of the project’s fundamentals. By examining the team, tokenomics, community, and use case, while staying alert to market trends and security features, you can significantly increase your chances of finding the next big meme coin or project with lasting value.

In the next article, we’ll dive into how developers can launch their tokens on GasPump, providing a step-by-step guide for creators.